|

Good morning:

Demand is for wheat is suddenly quite strong after a winter of hibernation. However, the price has stabilized at about $17-$20.50 depending on location with some exceptions for spot loads. Best prices are in southern AB-SK and fade down as transport costs hit the north country. It is my opinion that this represents a stabilization in organic trading and a new normal for prices. I am looking 1500 MT milling wheat in the $19-20 range south AB-SK, one spot load high end milling wheat in Alberta at $22+ but should at least be scalped if possible -- delivery terms possible; and a price indication on ~400 MT feed wheat. The quality on the milling wheat must as a rule be quite high (min 12.5 pro, dry, good FN, etc). I am looking for sources and price indications on feed grade organics for export, flax through barley and peas. Buyers are in a state of being completely uninterested until they aren't and then they want the stuff yesterday. The more information you have, the better. Thanks and have good day. Andrew Turner Broker 587-287-8447

0 Comments

Good morning:

I'm seeing steady demand for yellow peas and have been all winter. What this means for producers I don't know, except to state that the demand for no-chemical protein is high and steady. Bring forward any peas you want sold as the prices are solid and steady in the $23+ range for southern areas. I have buyers interested in ancient grains (einkorn, spelt, khorasan, etc). Consider planting a few acres or if you have some, by all means let me know. There's a lot of guardedness with the special grains in order to keep prices up but in my opinion all that results is a lack of price and market discovery...meaning that in the long run, an opportunity goes out the window due not to lack of interest but lack of knowledge. Our rail bid system is up and running. This allows special order delivery door to door and I believe would be of interest in points east of Manitoba and south into the U.S.A. I'd like feedback on the prior weeks' new crop crop contracts on flax. What do you think? In parting: There is a good steady market and demand for yellow peas driven by overseas buyers. Good demand for red milling wheat but must be of quality to expect much price wise. Consistent demand for ancient grains so consider planting some out if you can find seed. Consistent demand for organic hard white white both winter and summer. Let me know. Thanks, Andrew Good morning:

As the new season approaches please bear in mind the following new crop offers: Buyer looking to contract up to 1000 acres from several growers for organic hull-less oats at .25 lb CAD FOB. Total production with AoG. Grower must supply own seed and proof that seed is hull-less type. Organic status and current certification is required; southern Sask preferred production area but will discuss. Buyer looking for organic brown flax at $45 FOB 10 bu acre AoG; contract terms tbd. Offering Sep-Dec movement. Southern Sask preferred but will discuss. Different buyer than oats. Buyer of organic brown flax will also look to discuss golden flax production contracts at $50+ As a heads up, a buyer will be coming out with organic and conventional yellow pea contracts later this month and on into early March. Stay tuned. For today, if you have any organic or conventional triticale I have a buyer looking for 150 mt of each. Price dependent on location. Thanks, Andrew Good afternoon:

Last week's sales and prices realized were encouraging. It's too soon to call it evidence of a trend but regardless, buyer sentiment seems to have improved on at least some crops. For how long, I have no idea; and to what end, I also have no idea. As a general rule most crops are down right now, with conventional barley often trading lower than conventional oats. Prices realized last week were: Brown Flax $47 FOB March-April Golden Flax $65 FOB Feb-Mar Red Lentils $69/$1.15 FOB Feb HRSW $21 FOB Feb-Mar-Apr (retail ready close to market; expect closer to $18) Yellow Peas $22.50 FOB Feb-Mar I need conventional glypho free yellow peas SE SK and MB $13 FOB, organic yellows #2 or better $22-23 AB-SK-MB FOB; red, green, and French lentils, and conventional rye offering $7-8 FOB in Alberta. I also need 20-60 MT of organic golden flax mid $60's. New crop contracts are offering $45 for organic brown flax. New crop organic peas will be issued in March. As always, premium product attracts premium price. Have a good day. Let me know what you have and what you're after. Andrew Turner 587-287-8447 atuner@qualitygrain.ca Good chinook morning:

The organic market has been very slow as buyers and sellers adjust to the new normal of higher interest rates and abundant inventory on most crops. Movement has primarily consisted of good organic durum and flax with prices on both falling somewhat. Almost all movement is spot purchases and they change price from hour to hour. There is a continual demand for organic pulse crops but at the same time buyers are quite firm on their pricing which has also fallen slightly. The prices on offer are quite location dependent with higher prices in the south. I have a buyer offering new crop organic flax for $45 bu Sept-Dec 2024. Buyer prefers within 500 km of Yorkton but will look at all options. If you are a buyer or producer interested in new crop contracts please contact Quality Grain. I have a producer offering new crop organic yellow mustard 84/MT looking for indications FOB Stornoway MB. I have a buyer looking for 100 MT Organic Green Peas and another looking for Organic feed yellows farther east the better for Minnesota delivery. I have a couple loads of organic screenings one primarily wheat at $300/mt and the other peas-oats-weed seed at offers over $200/mt. Please contact me for more information. There's a lot more on offer within the system, both asks and sales. Have a good morning, Andrew Turner Good morning:

Organic cereals are still quite solidly in a long slump. American producers are reputed to have tons of inventory and their new crop contracts are barely even started. Small loads of all commodities are particularly hard to get a firm offer on so if you have loads that are less than a Super B bear in mind you'll probably need to deliver to get anything out of them. Most organic transactions and especially cereals transactions are spot deals and they change from hour to hour so your attention is key. If you have conventional crops to sell on your farm it may be a good way to mitigate your organics. That said, I need 1000 MT of yellow peas in the $22.50 range del'd St. Paul, and 100 MT of good green peas. There's also a need for good durum. And as always, bring your organic and conventional crops forward both for sale and to buy. Sincerely, Andrew Turner -- Quality Grain Marketing Est 2002 Broker Organic And Conventional. Pulse, Specialty, Cereal 200+ buyers C/Text: 587-287-8447 Three Hills, AB Good morning:

Organic prices are holding steady as consumer financial stress moderates consumption. Organics are still a luxury good and with the increased cost of living many consumers are being forced to purchase groceries in the conventional aisle of the store. Ultimately your grain prices are determined by that besieged mother dragging her two grumpy kids through the checkout, whether that mother be in Canada or Holland or Japan or the U.S.A. or wherever. That said, we have buyers looking for: -- a load of organic durum in Alberta -- 150 MT of organic yellow peas in SK -- organic green peas Montana-SK-AB -- organic oats in MB -- organic rye and barley in SK On the sale end: -- Organic Red Fife 3 loads SW SK sold as retail ready $26 -- 450 MT organic barley sold as feed indication $10.25 N AB -- 3 loads organic malt barley SE SK indication $11 offers -- 1 load organic yellow peas Montana $24.75 CAD del'd Saskatoon area -- Organic Canola Oil $2400 MT loaded bulk trucks -- Organic Canola Meal Pellets $1300/MT loaded N AB and can arrange for rail to QC/ON Please feel free to contact me with any questions. Thanks and Merry Christmas Andrew Turner Organic Broker, Three Hills AB (587) 287-8447 aturner@qualitygrain.ca It’s been an interesting week.

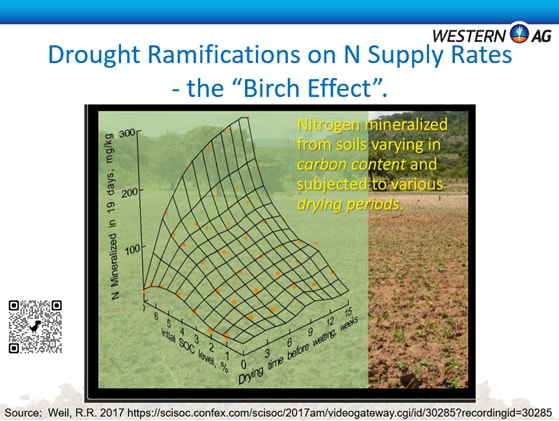

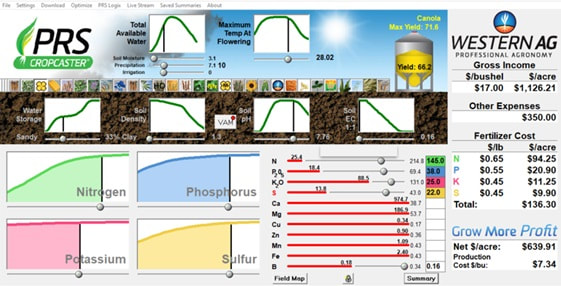

Coming at organics as a broker and consumer (I only grow on a small scale), I think my primary thought on marketing organic crops is that the market rules. I say this because time and again over the weeks I am approached for a price float on a given organic product but what the producer has in mind is the price spikes of the past few years on their crop. This isn’t unique to organic producers but does seem to be more common. In my opinion the COVID price spikes were an anomaly and will not be repeated. Nor is there any point in planting according to last year’s or two year’s ago prices in the hope of a similar return this year. The market is flat or falling for nearly all products, except organic pulse. There are sudden one-off high price buys but these are the exception, not the rule, and holding out for them is a game of dice. Buyers are contracting into the spring already and prices are not rising. It is my thought that increased costs on the reseller and consumer end of organics is leading to a general price stall because organics are a luxury consumer item and when pressed for cost consumers are forced to shop cheaper. In commodities substitutions reign King. For maximum price, know what it is you’re selling and have it ready. Have lab reports on hand and know what you’ve got precisely. You will not get good, or many bids, if you can’t tell them what they’re trying to buy. Buyers (any of them) want speed and certainty. The best prices are reliably going not to the best crop, though that helps, but to the grower with the fastest and most professional information on their crop. While an elevator report helps, at best it’s considered a guesstimate. We need to remember that there is not a century of status quo on organics. Each deal is unique, each field is unique, each crop is unique. The opportunities are great but so is the potential for loss. Balance is needed. They say the markets are dictated by fear and greed but I have yet to see either quality make for a sensible decision. I do have some thoughts on specific crops. The milling wheat market is being largely driven by specialty millers who must have perfect product. This is not a matter of buyers being whiny or trying to chisel you down, this is a chemical fact. Single source whole wheat flour can be extremely difficult to bake with and the grain that produces it must adhere to defined specs in order to bake a loaf of bread that isn’t a brick (or a massive sponge). Millers want perfect wheat. Buyers pay for perfect wheat. Conventional can hide behind less than perfect because they blend dozens of loads into one; organic can’t do that. There is a ton of organic rye on the market. Most sellers are holding out for a given price. My comment is, take what you can get – you’ll likely get a better price than everybody behind you. There are a ton of organic oats on the market. Take what you can get. It is an opportunity for a grower to create a reliable basic cash flow as the buyers are established and strong but those buyers also name the price. Bread wheats are holding steady in the $21 +/- range. You might get $23 for cleaned product. You might get a premium for Red Fife or named heritage wheat. Take what you can get. If you want to camp out for a price you may be camping out for a lower price. Barley is rare-ish and shows massive price variance. Shop around. Organic pulse is rare and sought for but remember that the other end needs to make a profit and that the product must be quality. If you want a good price and fast transaction for organic mustard sell it cleaned and have spec on hand. Nobody wants to ship dockage. Expect to dicker on prices. Organic flax is strong. If you’re not happy with the price hang tough. For forage and associated specialty seed there’s demand but that market is particularly finicky on purity. Feed grade and screenings have a market as well but the buyers are looking for a deal. It can be a great way to rescue a bad day. Come with fair expectations. To conclude, look at your ROI for each crop and calculate individually and as an aggregate. Don’t sell on wishes sell on reality. The only thing more lame than a low price in January is that same low price in May. Cost of carrying is more real than ever. Bring buyers firm third party information on the crop and have it ready on demand, or better yet present it all up front. Good sellers (as well as good buyers) rise to the top. There is far more room for competitive advantage in organics than in conventional. Much of that advantage simply comes from being willing to take fair prices and offer clear, concise, fast information on what it is you are trying to sell. I might also add that buyers prefer to deal with sellers who are game to sell and not simply floating prices or holding out for the highest bidder. An offer, often as not, doesn’t last the week. Dumping a contract -- which, fortunately, is rare -- in order to hold out for a few more cents is a great way to get cut entirely. To summarize: the best business and best prices are going to good but not necessarily the best product provided by sellers who are willing to sell at a fair price and who provide the information and product the buyer wants quickly and thoroughly. No luck, no unicorn hunts, no kinda-sorta. Those are one man’s thoughts. Sincerely, Andrew Turner Organic Broker, Three Hills AB (587) 287-8447 aturner@qualitygrain.ca Good Day, Here is a very interesting article on the “Birch affect” in regard to soil fertility levels and the impact dry soil conditions have on the availability and release of nutrients. The article is written by Edgar Hammermeister of Western Ag Professional Agronomy. I have worked with Edgar helping market his grain from the Alameda, SK area for 15 years. As we talked about crop production and soil fertility, I realized he had information every one needs to maximize profits. Take a read and let me or Edgar know what you think. It’s like déjà vu all over again. Yogi Berra As you receive this newsletter, harvest is likely well underway. The warm (to hot) and dry conditions have moved crops quickly into maturity. Across the prairies, there was significant variability in moisture available to start and grow the crop. The varying circumstances not only affects crop yield potential but also nutrient cycling in the soil and can have a large impact on future fertilizer management if it is accounted for. When soils go through extended periods of drying, there are some physical and biological changes that occur. These changes can result in a nitrogen (N) mineralization potential to build and release, a process sometimes referred to as the “Birch Effect”. The greater the organic carbon content of the soil and the longer the dry period, the greater the potential for plant available N to release once a drought ending rain occurs. The potential for N release can range from tens of pounds to over 200 lb/ac depending on what soil zone you are farming in and the condition of your soil. The N mineralization burst is difficult to predict with conventional soil testing. As a result, it has not been talked about much. The conventional residual soil nitrate test measures just that… residual nitrate. It extracts the “left over” or residual nitrate-N and does NOT account for the organic N supply often referred to as “mineralization”. When soils go through drought, the biology shuts down and no N mineralization takes place. If the crop yield was good to average and a dry fall persists, a conventional soil test will read low in nitrate-N because the plants have drained the nitrate-N pool and mineralization of organic N has not yet replenished this nitrate-N pool. Western Ag Professional Agronomy uses the Plant Root Simulator (PRS®) probe technology to measure the nutrient supply power of the soil and a sophisticated computer model, the PRS® CropCaster, to interpret the probe data. The PRS® lab protocol for dry soils, triggers the Birch Effect in the lab and the PRS® analysis is able to measure the plant available N supply power. In the 25 years of CropCasting, the last three years have been some of the most interesting. The dry fall of 2020 saw Western Ag customers significantly reduce N application rates planned for the 2021 crop. No one anticipated the drought, but farmers using PRS CropCasts, did not see the same high soil residual nitrate tests… because the fertilizer N wasn’t in the soil to begin with. The N was safe in the bin, it was better for the environment, and, most of all, it was better for the pocket book. The fall of 2022 showed the same trend, planning for crop year ‘23. There were high N supply rates allowing for reduced N applications at seeding. Should dry conditions persist into the fall, what am I anticipating for the fall of 2023? We have seen this before. Ask any Western Ag Professional Agronomist or farmer customer about how the PRS® CropCaster can compare “What if” scenarios based on changing crop type, fertilizer, weather and economics and help you “Grow More Profit”. https://www.youtube.com/watch?v=LdFSAQmzsZ0 Edgar Hammermeister, PAg C 306-483-7289 me.hammer@westernag.ca www.GrowMoreProfit.com Edgar Hammermeister is a Professional Agrologist and a Western Ag franchise owner located in South East Saskatchewan. He has been providing crop planning services for area farmers since 1998 when the PRS technology first became commercially available for use. Western Ag has over 35 agronomists situated throughout Saskatchewan and Manitoba. The Western Ag PRS CropCasting® service includes soil sampling, lab analysis, cropcasting and a post harvest review called “backcasting”. Hope you all found this as interesting as we have. Let me or Edgar know what you think

Till next month, Richard Chambers Marketer - Brandon, MB 204-729-1354 - Office 204-761-8320 - Cell richard@qualitygrain.ca Good Day,

I just got of the phone with a reseller that I have faith in. He tells it as he sees it. We were talking about the price of feed grains and why they are going down as we are heading into the main feeding season. We agreed that there are several reasons but likely the number one reason is that the US grew a decent crop of corn, and the Mississippi River is at a 10 year low. Back in October it was even closed for barge traffic for a short period of time. They moved in and dredged the 2 main shallow spots. This is good but they were only able to open it up to 1 way traffic. This problem is likely to continue into the spring or until the next major moisture falls. This has forced sellers to look elsewhere. Feedlot alley in Southern Alberta has become a major place to ship corn. The number we heard was 20-unit trains have been sold for unload Nov/Jan. This has taken the push away to buy either Canadian corn or barley. This has caused delivered bids Lethbridge to drop $20/MT and FOB farm numbers to drop by corresponding amounts. Barley bids into Lethbridge are now around $445/MT delivered for Jan/Feb/Mar delivery with feedlots having good coverage so far. Will this change and prices go back up? No one will venture a guess on this. I know I won’t. It is something to think about. So far, we have been lucky in Western MB as we still have decent demand from the hogs. This has stopped the drop at $15/MT for now. Just one other thing that the brokers at Quality have been talking about is how there seems to be large volumes of good oats in bins and many producers have $6 on the bin door. We are still seeing our better oat bids ($5.00 picked up – location dependent) being for further out. Many of the buyers are covered until March. Just food for thought. A bit of a heads up for producers in Western MB and Eastern SK. We are hosting a meeting with Western Ag Labs (nitrogen soil testing) and ADM Fertilizer (future price outlook) in Virden at 1:30 PM on Dec 12th at the Legion Hall. I hope many of you can make it as I think it will be interesting. And it would be a chance for us to put faces on many of your voices. Please put it on your calendar. On a final note we have buyers in Manitoba on the lookout for conventional Gluten Free Oats so if you have some and are in MB/Eastern SK let us know what you have and we will price it for you. Till next month. Richard Chambers Marketer - Brandon, MB 204-729-1354 - Office 204-761-8320 - Cell richard@qualitygrain.ca |

AuthorReed McDonald - Owner and chief blogger at Quality Grain Marketing. With all the noise and click bate headlines this agricultural based blog will highlight what current events I am following. Be sure to check in regularly for updated musings Archives

April 2024

|