|

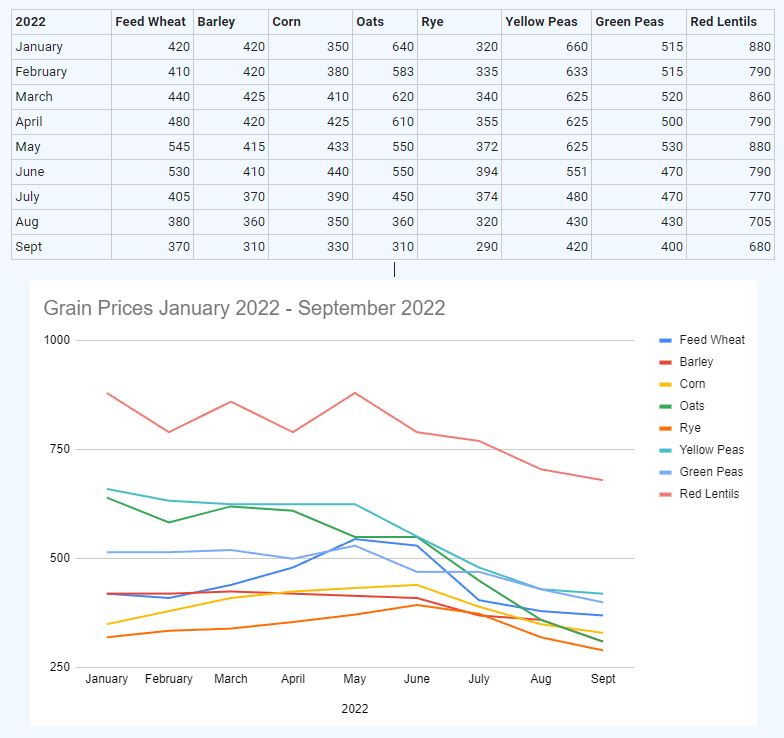

Good Day, We have been getting considerable interest from producers on new crop pricing across all commodities. The prices keep moving down gradually. This is likely the trend for the next while. Right now from what we are hearing there isn’t much reason for the prices to go any other direction. There is a good crop coming. Most producers are saying better than last year and some are saying as good as they have seen. Producers always keep looking for a light at the end of the tunnel. We continually have guys say “look at all the hail that has fallen, I heard of this storm with softball sized hail”. Unfortunately, or fortunately, we have never had enough hail in western Canada to move the markets up or down. If you have had hail, it is a disaster but only for you. It will not significantly affect the supply or price of grain in western Canada. Another thing to consider in the feed grain markets. What happens if it gets down to minus 5C for a night at the end of August or first week of Sept? We will have a million tonnes of feed wheat. This will peel $40/ Mt off the feed grain market overnight. I am not saying this will happen but if it does the $6.25-$6.75 bids we are getting for new crop barley for Sept/first half October movement will look pretty good. Just food for thought. I will now pass it off to Reed to do a hopefully brief mid year review on commodity prices since January. Very similar to my New Years Review highlighting the change in prices in 2021 I will do a same brief summary for what we have been seeing in 2022 while compared with 2021 prices for September. Feed Wheat started the year near $11.50/bus and was driven by world news (Ukraine War) up to highs of $14.40/bus (yes for feed) at the start of may. Prices have now come down fairly rapidly and we are seeing close to $9.25-10.00/bus depending on location picked up in the yard. Feed wheat in September of 2021 was trading around $10.50-11.00 bus off the combine for comparison.

Barleyremained fairly flat throughout 2022, peaking in March at $9.25/bus picked up in the yard and slowly crept down. The highest price we traded for barley in 2022 was $9.50/bus picked up (primarily because of location). Since those highs barley has settled in around $6.75/bus and we suspect it has more room to fall come September as barley volume available increases dramatically. September 2021 barley was $8.00/bus picked up for comparison. Corn has had an interesting year, never matching the MT price until May. Much of this has to do with the amount of Corn that was bought and brought up in the USA in Oct/Nov of 2021. Feed requirements were met as a substitute for barley. Still a couple months before we will have a stronger grasp on the 2022 crop but expectation is most feeders will switch back to barley leaving a large chunk of corn up for grabs into ethanol/distilling. Currently we are seeing off farm bids on corn just shy of $9/bus. Nearly identical to what we were seeing in September of 2021. Oats have had the largest run up and a matching crash. The highest price we traded oats in 2022 was $10/bus picked up in the yard. We heard reports of higher numbers at the line companies but never verified, my understanding was demand was limited. Today good Milling oats are fetching bids in the $4.25/bus picked up in the yard, currently below feed oat bids of $4.50/bus. September 2021 Oats were trading at $6.50/bus for comparison. Yellow Peas are trending a similar direction as oats, but perhaps not as drastically. Yellow Peas hit their top in January at $18/bus but held their own until May where they dropped below $15/bus. Current bids are in the $11.50-$12/bus range for September compared to 2021 bids of $15/bus off the combine. Green Peas I might be one of the few that share this opinion but I feel they have held their own fairly well when compared to the volatility in Yellow Peas. Yellow Peas have fallen $6/bus from their peak while Green peas tickled $14.50/bus in May 2022 (in October 2021 they briefly hit $16.50/bus) and now are in the $10.50-11/bus range. Red Lentils were up around $0.40/lbs in January and have steadily decreased since. The top Red Lentil trade we had was $0.52/lbs fall of 2022. Currently Red Lentils are receiving bids around $0.30-0.31/lbs vs $0.45/lbs in September of 2021. Overall, all I can recommend is if you are worried about bin space or cash flow right now is the time to consider booking in your September/October grain. The line companies will be more than happy to take prompt movement on your grain for prices that were dollars per bushel below what you could have booked in with us a few weeks prior. If you have the ability (financially, storage space, stomach to watch some price swings) to hang on beyond the wave of grain that will be coming off the combines this fall good on you as it is anyone's guess where this market will be come January 2023. Till next month.

0 Comments

|

AuthorReed McDonald - Owner and chief blogger at Quality Grain Marketing. With all the noise and click bate headlines this agricultural based blog will highlight what current events I am following. Be sure to check in regularly for updated musings Archives

July 2024

|