|

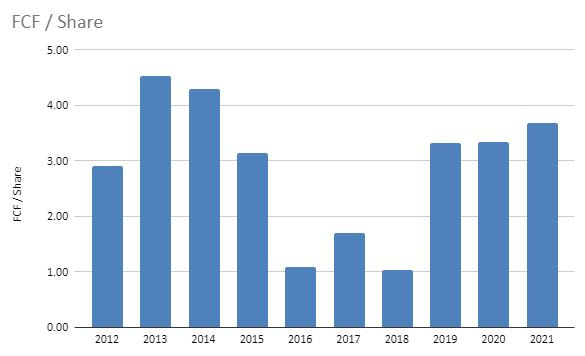

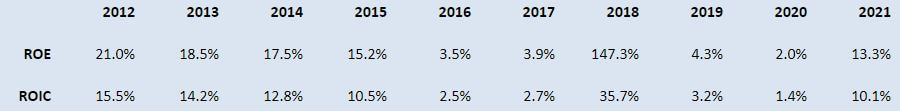

1. ADM & Marathon Petroleum building a new Soy processing Facility in Jamestown ND - This will be North Dakota's first dedicated soybean processing facility. Construction should be complete by Fall 2023 and expects to process 600 million pounds of vegetable oil per year used by Marathon in the renewable diesel market. 2. Rosetown SK to be the home of a micronutrient fertilizer facility that turns grain left overs into fertilizer - This will be a 50-50 joint venture between AGT and Lucent BioSciences. The fertilizer will be called "Soileos" by reusing pea, lentil, and oat hulls. Early trials on Durum acres have shown promising result at increasing protein content and better soil health. 3. PIP International will be constructing a new pea processing plant in Lethbridge AB that will process 125,000 MT of peas - Construction to start late 2022 on a new $20 million pea processing facility. The 2nd phase of the project will be a $150 million facility that will process 126,000 MT of yellow peas per year for protein extraction. 4. Phyto Organix Foods Inc. is planning to purchase 15 acres of land near Strathmore AB to build a $225 million pea processing facility - Expected to open by 2024, Phyto Organix will be fractionating peas to process 40,000 MT of yellow peas for protein extraction, fibre and starch products, and pea hull fibre. The plant is projected to be the first net zero plant protein processing facility in North America and expects to source peas locally. 5. A financial dive on Nutrien Ltd. - Nutrien (NTR) is a company most of us have heard of and dealt with over the years. They were formed in 2018 as a result of a merger between PotashCorp and Agrium producing Nitrogen, Potash, and Phosphate marking NTR as the world's largest fertilizer producer by capacity. I have this as number 5 today because I know many people aren't interested in investing and will most likely skip over my quick analysis. When investing I like to look at companies that are in my day to day life, Nutrien happens to be a company that shows up fairly frequently. This helps me connect meaning and understanding when considering a possible investment. This is not financial advice and solely my opinion and no one else's. I do not have a position long or short in Nutrien. All calculations are done based on todays stock value of roughly $83/share USD and the 2021 financial statements. 1. As discussed above, NTR makes money by selling Crop Nutrients aka fertilizer. They produce 20% of the global production of Potash, are the #3 global nitrogen producer, and are the 2nd largest North American Phosphate producer. Crop Nutrients made up 41% of their 2021 Revenue and Crop Protection products made up 35% of their revenue. When you break down their Crop Nutrient sales it is made up of 44% Nitrogen, 38% potash, and 18% phosphate. As a business it is evident that NTR is a very cyclical company that relies on the ebbs and flows of the commodity market. When commodity prices increase their margins increase and vice versa. For Example 2021 Margin was 20.2%, 2020 - 9.2%, 2019 - 12.4%, 2018 - 12.8%, 2017 - 10.1%, 2016 - 13.9%, 2015 - 32.3%. 2. NTR generates a positive Free Cash Flow (FCF - the money available for a company to pay creditors, dividends, or buy back stock). Over the past 10 years NTR has ranged from $1/share up to $4.50/share of FCF. In 2021 they generated $571 million which is $3.68/share. When plotting FCF it becomes evident on how cyclical the industry is really highlighting the boom bust nature of the industry. 3. NTR is in a dominate market position in the North American fertilizer industry. By Market Capitalization they are #1 at $40 Billion (next highest is Mosaic at $23 Billion). As discussed earlier they are #3 in global nitrogen production, #2 in North American Phosphate production, and #1 in World Potash. 4. Barriers to become a competing Fertilizer company are massive further illustrating the dominate position NTR is currently in. If you or I wanted to start a company to compete we would need billions of dollars to purchase plants to produce synthetic Nitrogen - not to mention the cost of the inputs to create said nitrogen. As for Phosphate and Potash we would have to discover or purchase large mines to even begin the journey as a competitor. We may see competition from alternative fertilizers if prices continue to swing upwards such as the Rosetown Soileos but it has yet to be proven as a viable alternative (not saying it won't but it hasn't yet) and won't be a threat for years into the future. 5. I personally like to invest in companies that prove they can provide a consistently high return on capital. For these numbers I consider Return on Equity (ROE) and Return on Invested Capital (ROIC). ROE is simply Net Income/Equity, both numbers can be easily found in the financial statements. However, ROIC, factors in the amount of long term debt a company has. For the last 15 years governments around the world have been running easy credit monetary policies providing access to cheap debt, but with rising interest rates debt is a real threat to the health of a company. As of 2021 NTR had long term debt of $7.5 Billion. Using that $570 million in FCF it would take them 3.5 years to pay that down if they allocated a 100% of FCF to the cause. From this chart you can see how debt lowers the ROIC when compared to the ROE. The cyclicality of the business is highlighted by these numbers but it is clear NTR does a good job providing solid returns on their capital.

6. Being in the commodity business relying on commodity pricing and mining operations creates a fair amount of extrinsic risk. When supply out paces demand we see fertilizer prices drop rapidly. This has happened time and time again. Other external risks that need to be considered are Government Regulation, producer defaults, supply chain risks (this proved to be beneficial to NTR during COVID). These risks are external and therefore they can't be controlled by NTR. There are many more internal and external risks to be considered and can easily be found in the companies annual filing (in this case the 40-F filing). 7. NTR has a fairly healthy balance sheet. Biggest strike against them is the $7.5 billion in debt with only 500 million in cash, and generating roughly another $500 million in FCF. The debt to FCF ratio of 3.5 is not a huge concern but definitely something to keep an eye on. The Equity is steadily growing at roughly 5% per year, Earnings which are cyclical have not expanded in 10 year period but stayed much them same, operating cashflow has been similar to earnings, and finally sales have grown on average at annual rate of 9%. 8. Management at NTR has shown high turnover since the Agrium and PotashCorp Merger. Chuck Magro was longtime CEO/President of Agrium and continued with NTR until April 2021 where he left for Corteva (a crop input competitor). In 2021 it was announced Mayo Schmidt would become CEO/President but by January 2022 (after 8 months on the job) he had resigned and Ken Seitz was announced as the interim CEO/President. Ken has been with NTR since 2019 in the Potash department having experience in both agriculture and mining sectors. This turnover leads me to believe it is very hard to manage such a cyclical company in the public traded eye or the company is attracting mercenaries looking for the highest pay cheque. If the later is true that is usually not great for shareholders. 9. I like to run 3 separate valuations based on Free Cash Flow analysis, Owners Earnings, and a Simple Intrinsic Value. These values are all in USD Free Cash Flow Method - I am using an average FCF/share of $2 (that I picked based on looking at 10 years of FCF data) and compounding it at an estimated growth rate. In this example I have come to the conclusion over a 10 year period of time the only thing that appears to be growing is sales at 9% while my other key metrics are closer to 0-5%. For simplicity sakes I will use an 8% overall growth rate. To get this company at a good on sale rate the $2/share FCF at an 8% growth rate in 8 years that would compound to $23/share. In 16 years that would be $43/share pay back. Owners Earnings - Using Operating cashflow and subtracting out capital expenditures required to grow the company (approx 70% is used to maintain the company and 30% used for growth) I come to a rough valuation of $90/share that this company could realistically return to the owners if they decided to sell shop and pack it in. Intrinsic Value - For this calculation I take current Earnings Per shares of $8/share and extrapolate their growth over the next 10 years. In 10 years I would expect that value to double once and grow a tiny bid extra at 8% growth (Rule of 72 makes for quick estimations on growth rates). That grows EPS from $8 to roughly $17/share 10 years from now. Earnings per share work with the Price/Earnings ratio in a way that PE x EPS = Share Price. A rough rule of thumb is a PE ratio is typically twice the Growth rate so in this case 8 x 2 = 16. 16 PE x $17 EPS = $272 Per share 10 years from now. I personally look for a 15% return on my investments meaning I want the investment to double every 5 years (so twice in 10 years). For this to come true I have to buy these shares at 1/4 of the future price for this to reach my 15% target. $272/4 = $68/share is the fair value today (this math is based on the knowledge of Rule of 72 and basic ratios. 72/15 = double every 5 years. So in 10 years $1 would grow to $4 creating a nice neat ratio of 1/4 representing a 15% return hence the $272/4). I am a subscriber to I would prefer to be approximately correct vs precisely wrong so rough numbers work well when calculating valuations. Based on these three different valuation methods I come up with three separate values. $43/share based on free cash flow growth and paying for the company in 16 years. $90/share based on the companies Operating Earnings and subtracting out what it costs to maintain the company every year. And finally $68/share based on the company growing their earnings at 8% annually for the next 10 years. Unfortunately in this case we have come up with 3 fairly different values making the proper value even that much harder to thumb. Personally I would estimate it is somewhere between the $70-90/share that the two methods calculated. At $80/share that would indicate the market has priced this company fairly accurately and is not under priced or grossly overpriced. Conclusion - Running through these quick 9 points is not enough research or thought to determine whether Nutrien is a good stock to buy. My final point on valuation shows they are fairly priced and therefore not really an investment that I am excited about today. NTR is an interesting company and might be worth digging deeper and doing more research to be ready if and when their price follows their next commodity cycle down. At my current level of comfort I would consider purchasing them around $30-40/share USD. I do certainly believe this company will be running strong for the foreseeable future.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorReed McDonald - Owner and chief blogger at Quality Grain Marketing. With all the noise and click bate headlines this agricultural based blog will highlight what current events I am following. Be sure to check in regularly for updated musings Archives

July 2024

|