|

Today I will be looking at John Deere. Many of you already own the equipment but should you own the Stock? I will be diving into a quick analysis on the Deere (DE) stock traded on the NYSE and the current share price is around $320/share (July 27, 2022). This gives DE a market cap of 97.6 Billion and a PE ratio of 16. I do not have a position long or short in Deere, and all calculations are based on todays share value (roughly $320/share) and the 2021 financial statements. John Deere is a global manufacturer of agricultural, construction equipment, industrial machinery, diesel engines, and lawn and garden equipment. Founded in 1837 by John Deere in Grand Detour, Illinois, it's now headquartered in Moline, Illinois with 70,000+ employees worldwide. DE have been around for over 160 years, but they've only been publicly traded since 2002. They are the largest manufacturer of tractors in the United States. The company originally started as a blacksmith shop owned by John Deere, who also farmed, and in 1886, he built what would become his first tractor. He sold it at an auction in Moline, Illinois for $130 (about $3200 today). 1. As discussed above Deere makes money by manufacturing and selling tractors, engines, and other machinery. Total revenue in 2021 was $44 Billion with 41% of that coming from their equipment operations sales and 57% of total sales coming from USA & Canada. They separate their business into 4 main segments: Production and Precision Agriculture, Small Agriculture and Turf, Construction and Forestry, and Financial Services (FS is John Deere's internal bank for financing/leasing equipment). Sales of equipment are affected by many factors such as farm cash receipts, commodity prices, acreage planted, crop yields, general economic conditions, and government policies just to name a few. While none of these factors are all that predictable Deere believes they will have continued success navigating these waters well into the future. Operating Margins have ranged from 16% to as high as 22%. We have seen revenue grow from $35.6 Billion to $43.58 B which is about a 5% annualized growth over the past 10 years. 2. Deere’s Free Cash Flow (FCF) from the past 10 years is not all that inspiring. I prefer to see a chart stepping up, not 4 years of hugging $2/share mixed in with some negative years and then an absolute explosion into the mid teens. The increase in Net Income in 2021 vs 2020 was $3.2 Billion ($5.9 B vs $2.7 B), for you accounting nerds, I feel like this should have had a greater effect on Operating Cash Flows, however, $2.5 billion in increased inventories and $1.8 Billion in accrued income taxes create similar FCF despite the large increase in earnings. The explosion from 2019 to 2020 is primarily due to inventory management and financing receivables, which seem to be correlated. Financing receivables is a real can of worms which complicates Deere’s operations in the sense they are more of a bank themselves vs strictly a machinery manufacturer + dealer. Based on my limited abilities when it comes to analyzing banks I am suggesting Deere’s FCF is not as simple as looking at this graph and showing steady growing cash flows. However it is clear they did earn $34/share in FCF over the past 10 years vs $21/share the previous decade. 3. Deere competes with companies in both the Agriculture machinery and other heavy duty equipment industries. The competition includes Caterpillar, Kubota, CNH Industrial (Case IH, New Holland), Claas, and AGCO Corp (Challenger, Fendt, Gleaner, Massey Ferguson). By sheer size Deere's closest competitor is CAT and they are neck in neck in terms of market capitalization, revenue generation, and net earnings. Market Capitalization Deere ranks #1 at $97.6 Billion, #2 CAT at $96.94 Billion, and #3 goes to Kubota at $19.5 Billion. Revenue leaders are #1 CAT ($50.97 B), #2 Deere ($43.58 B), #3 CNHI ($33.4 B). Net Earnings - #1 CAT ($6.48 B), #2 Deere ($5.96 B), #3 CNHI ($1.72 B) 4. Deere is one of the most recognized brands in North America, we would be hard pressed to find someone who has never seen or heard of John Deere and their colors. Barriers to enter the industry are fairly large but not impossible to overcome. A company like Tesla could come in with lots of share holder money and a great design and disrupt the industry. We have seen brands such as Claas and Kubota come into the North American market over the past 20 years. While they don’t operate on near the scale Deere does, they have certainly tried and to some extent succeeded in taking some market share away. This is a long winded way of saying anyone can build a tractor, but there is some “secret sauce” in software, engines, design, manufacturing and distribution. Those barriers aren’t impossible to overcome, just expensive and very hard to overturn the “king(s)”. 5. Return on Equity (ROE) is at fantastic numbers for DE averaging 29% over the past 10 years. Return on Income Capital (ROIC - reminder) is not so black and white when considering that a lot of their debt is internal debt from acting as a bank to many of their customers when financing machinery. With this initial skin deep analysis I have not been able to uncover, with certainty, the amount of debt that is “internal” vs money that was borrowed “externally.” Between Short Term and Long Term debt Deere has roughly $43.81 B in debt. According to the notes about the Financial Services in the 10K Annual report $37.978 B is in relation to the Financial Services Operations. If I am correct, the amount of debt Deere uses to finance their operations is closer to $5.8 B making that number pretty insignificant when compared to Earnings, Operating Cash Flow, and Free Cash Flow meaning in that case ROE and ROIC would be very similar. That is a really good sign, but without learning the ins and outs of Deere’s “Financing Services” I for one would be hard pressed to blindly accept the ROE numbers. 6. Extrinsic risks

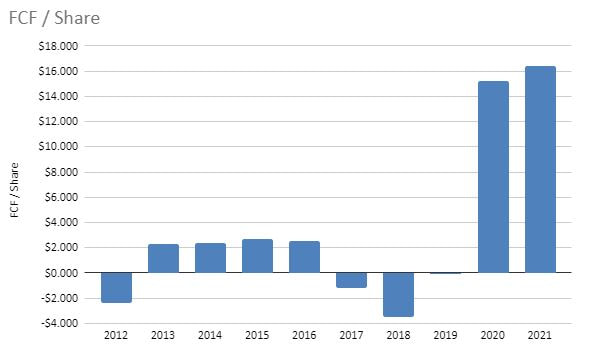

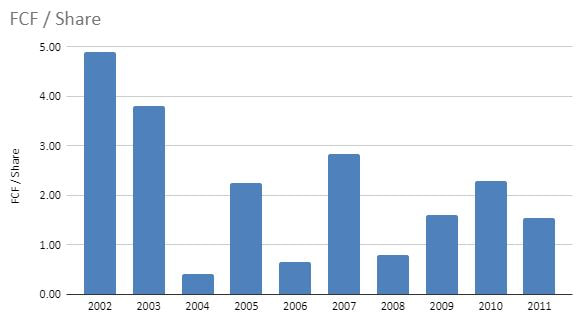

Political - No major political risks at this point in time. Regulations and laws may change but right now there is nothing that can’t be dealt with. Economical - Fairly large risk if the economical and environmental issues crop up all at once. Farmers take loans from Deere to finance/lease new machinery, flood, drought, natural disaster, etc multiple years in a row over many geographical reasons could spell trouble for Deere’s loan book. Saying that most of the debt is probably secured by collateral such as land and the actual machinery itself. 2008 provides a pretty good insight into how DE navigates through a large scale recession. Socio-cultural - Small/Medium Risk - Deere needs to attract and retain top talents, negotiate with large unions, and ensure their business practices adhere to societal expectations (pollution, safety, etc). Deere currently has a class action lawsuit in regards to the right to repair and many customers are not happy with the subscription based options they have been showcasing the past couple years (link). This last point is an issue DE will have to deal with but at the end of the day the consumers wallet will speak the loudest. Technological - Medium Risk - It is important to Deere to keep improving the technology services they can provide. If a competitor comes out with a vastly superior technology it could tempt loyal customers to switch brands. Smaller risk is having sensitive data being hacked or compromised. This last point is less concerning as we have seen this sort of thing happen in the past (think 2017 Equifax data leak). 7. DE has $8 billion in cash on their balance sheet and $43.8 billion in total debt (majority which is attributed to their “Financial Services” internally and just shy of $6 billion is attributed to outside loans). In 2021 they generated $5.1 billion in free cash flow (FCF). Between free cash flow generated in 2021 and cash on the balance sheet DE would have no issue covering external debt. The "internal debt" created by Financial Services something that I would need to dig deep into to understand whether it is of concern or not. 8. John May is current CEO and Chairman of the board. He has been CEO since November 2019 and has been with John Deere since 1997. John is 51 years old so potentially has a long runway to maintain his positions with Deere. He holds just shy of 74,000 shares (2.48% of total shares) with a market value of $23.6 million. In fiscal year 2020 John received a base salary of $1.2 million and total compensation of $15.58 million (mixture of stocks, options, and performance compensation). This compensation is fairly outrageous, however according to CNBC in 2020 the CEOs of the top 350 US firms made an average of $24.2 million putting John well below average (link). 9. For those who remember the Nutrien valuation, I like to value a company using three separate methods - Free Cash Flow Method, Owner Earnings, and a Simple Intrinsic Value. All values are in USD. Free Cash Flow Method - I am using $8/share FCF compounded at a growth rate of 10% per year. This gives me a $100 in FCF collected over a 8 year period and $315 over 16 year period. Owner Earnings - Using the operating cashflow and subtracting out Capital Expenditures (spending required to keep the lights on and DE competitive) I calculate owner earnings buy price at close to $240/share as a fair value price. Intrinsic Value - For this calculation I use current EPS TTM of $19.17 and extrapolate the growth over the next 10 years. At a 10% growth rate (using the rule of 72 it tells me 10% doubles every 7.2 years) I can estimate the EPS will grow to right around $50. At a growth rate of 10% I can estimate the PE Ratio will be close to 20 (a good estimate is PE is double the growth rate). Using EPS 10 years in the future and multiplying it by a PE ratio of 20 I get a estimated future value of $1,000/share. If you remember from the Nutrien valuation we can use a nice neat 1/4 ratio (representing a 15% rate of return $1 will double twice in 10 years so $1 becomes $4 - hence the 1/4 ratio) we get an estimated share price of $250/share. Based on these three valuation methods it appears fair value of DE is in the $240-315/share range. This shows me DE is either fairly valued or slightly over valued looking at this quick snapshot. Conclusion - For me this company is not currently on sale and I would need to dig into “Financial Services” to determine how money flows through that department and if the $8/share FCF and $19 EPS are numbers that can be grown on. At first glance, even Operating cash flow seems inflated in 2021, but this does not mean these valuations are incorrect but a lot more research needs to be done to get comfortable investing in John Deere at its current price level. Overall I am very curious about owning John Deere, however, the company is more complicated than I had originally anticipated. It might fall into the too hard category but at the same time with a lot more work and research I might be able to understand their financials on a more intimate level. At my current level of comfort I would be very interested in John Deere at $100-150/share price point. I fully anticipate Deere to be around for the next 10-20 years and beyond with the potential to keep improving financially as time goes on.

0 Comments

Your comment will be posted after it is approved.

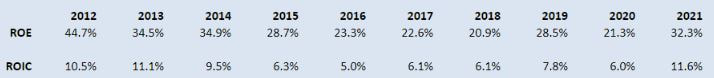

Leave a Reply. |

AuthorReed McDonald - Owner and chief blogger at Quality Grain Marketing. With all the noise and click bate headlines this agricultural based blog will highlight what current events I am following. Be sure to check in regularly for updated musings Archives

July 2024

|