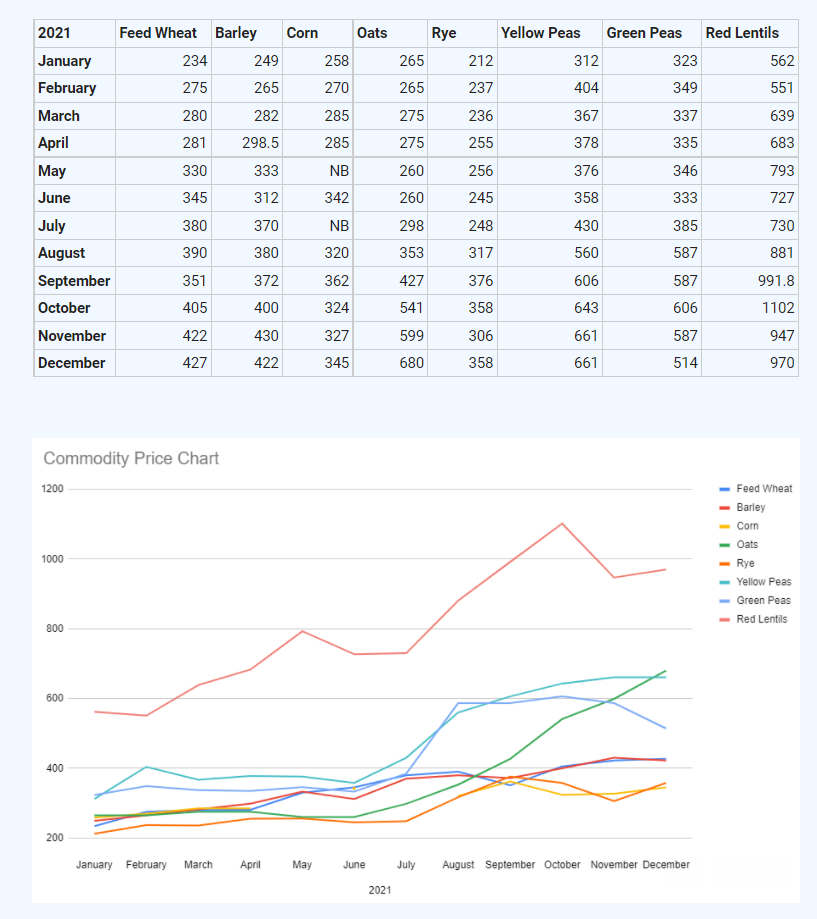

Happy New Year everyone! Hopefully everyone had a healthy and productive 2021 and can build on the positives and set the negatives behind for 2022. It was a roller coaster ride for many seeing extremes in both dry and hot weather impacting yields across Western Canada. I figured I would take a moment and do a high level Review on the Commodity Pricing we had seen for 2021. I randomly chose prices/locations in the middle of each month for commodities we traded the most throughout the year. Hopefully these charts are legible (formatting is always difficult). Red Lentils had an incredible run peaking in October at $0.50/lbs. I have had many buyers suggest they predict red lentils are going to continue to slide and settle in the $0.30/lbs range while producers are adamant they will be over $0.60/lbs Yellow Peas have been a wild ride. Off the combine in 2020 at $7.50/bus climbing to $8.50 by New Years, peaking in February at $10.75/bus, and bottoming in June at $9.75/bus. Off the combine in 2021 we were seeing $16.00/bus and then again climbing up to a peak in November at $18.00/bus Green Peas have followed a similar trend to Yellow Peas but have been lagging in value since January. Low of $8.80/bus and high of $16.50/bus. Hearing many producers are bullish on Green Peas for 2022, so we will wait and see what the market brings us Milling Oats were pretty steady from January until June around $4.00/bus. We had a pretty significant run up from June peaking in December at $10.50/bus FOB Manitoba but as mills fill up it appears the price is settling down in the $9.00-9.50/bus range (not shown on this chart but rather bids to finish off December) Barley and feed wheat have followed each other on a per ton price basis for the last 12 months. I honestly thought we were going to see peak pricing in August after the initial panic from the crop failures seen in Eastern Alberta and Western Saskatchewan however, par for the course, I was incredibly wrong with my prediction. Barley appears to have peaked in November around $9.40/bus right before Corn was being railed up in major quantities. Since the peak it has settled around $8.50-9.00/bus (dependent on location). Where it goes in 2022 is anyone's guess (hopefully their crystal ball is more reliable than mine) Feed Wheat peaked at $12.00/bus and has since settled in the $11.25-11.50 range coming into the New Year. We traded $443/MT FOB out of Brandon MB at the start of December and seeing $422/MT (Brandon MB) to close out the year Rye has been a hot and cold commodity, typically lagging the market and leaning towards cold. Corn and Rye are the only two commodities on our charts that did not eclipse $400/MT. Highest Rye pricing we have seen was $10/bus picked up spring 2022 but most producers don't want to wait that long to move it. So they will wait instead. Interesting strategy and we will see if it pays off Corn was trading neck and neck with barley and feed wheat from January until June but has since been severely out paced peaking in September (before the combines were rolling) at $9.15/bus. We have seen a small rally in December selling corn for just over $9.00/bus picked up If information like this is interesting to you I would suggest subscribing for an annual membership to the Quality Grain Daily Summary showing where bids are coming in and what is being traded on a day to day basis. This also includes a login to the website to view historical bid sheets. Price is $125 + GST for an annual subscription. See link below to sign up: https://www.qualitygrain.ca/store/p2/Quality_Grain_Bid_Sheet.html Or give me a call/email and we can go through the details directly. Thanks everyone for supporting Quality Grain Marketing in 2021 and we look forward to doing business with you in 2022. Whether it is brokering a deal or price discovery we are here for you. Reed McDonald Marketer/Owner - Calgary, AB 403-380-5044 reed@qualitygrain.ca Good day,

One of the things we as brokers/marketers are continually asked this year is “when do you think this run will end?” Unfortunately, our crystal ball is very cloudy currently. All we can do is relate to you the trends we have seen in the past few months and what seems to be the trends at this time. If you have been asking me this question over the last 18 months, I will have proved conclusively that I can’t foresee the future. We are always happy to give you our thoughts. This has been an amazing ride. The general trend seems to be always up with some crops outperforming others significantly. Oats are an example. Today we are at double some of the best prices we had ever seen until now. Anyone who said last March that we would see $10 oats in western Canada would have been called crazy. Just for a bit of context regarding world prices. Good quality milling oats are trading for 200 pounds/ ton in Great Britain. This works out to $5.80/ bushel CAN. (Sorry John this is just too valuable info to not share). As you can see there is room for a price correction no matter how high ocean freight is. And we are seeing oats moving in from offshore currently. The scary part of these prices is that they seem to be driving suppliers to charge unreasonable prices for next years’ inputs. I am not saying that your local fertilizer dealer is the bad guy here. He has no more control over his costs than you do. BUT someone is taking advantage. Just my thoughts. As mentioned we are seeing very strong prices. Milling oats $9.50 to $10, pearling quality barley was $9.50 to 9.80 - those bids have backed off. Feed barley 8.50 to 9.00. We are hearing that malt barley that has been rejected is starting to flood the feed market pushing the prices down. Feed wheat $11.50 to $11.75, Flax $36 to $42, yellow peas $17.00 to $18 (demand from the USA has been declining). These are just generalizations you need to give us a call, email or text with grading info and we can get you firm bids for your corner of the country. If we can help in any way with price discovery don’t hesitate to call any one of the marketers on the bottom of this newsletter. Until next month have a safe and happy Christmas whether you stay home or travel to a more exotic destination. Richard Chambers Marketer - Brandon, MB 204-729-1354 - Office 204-761-8320 - Cell richard@qualitygrain.ca |

Archives

March 2024

|